In the daily operation of banks, signing is an essential link. Whether it is opening an account, applying for a loan, managing finances, or managing enterprise accounts, every contract and every agreement requires customers to confirm in person. However, the traditional paper signing process is inefficient, costly, and accompanied by problems such as archiving and anti-counterfeiting. Nowadays, electronic signature pads are gradually becoming the "standard configuration" of bank branches, helping to speed up counter operations, enhance security, and upgrade the customer experience.

1. Why do banks need electronic signature pads?

Speeding up business processing

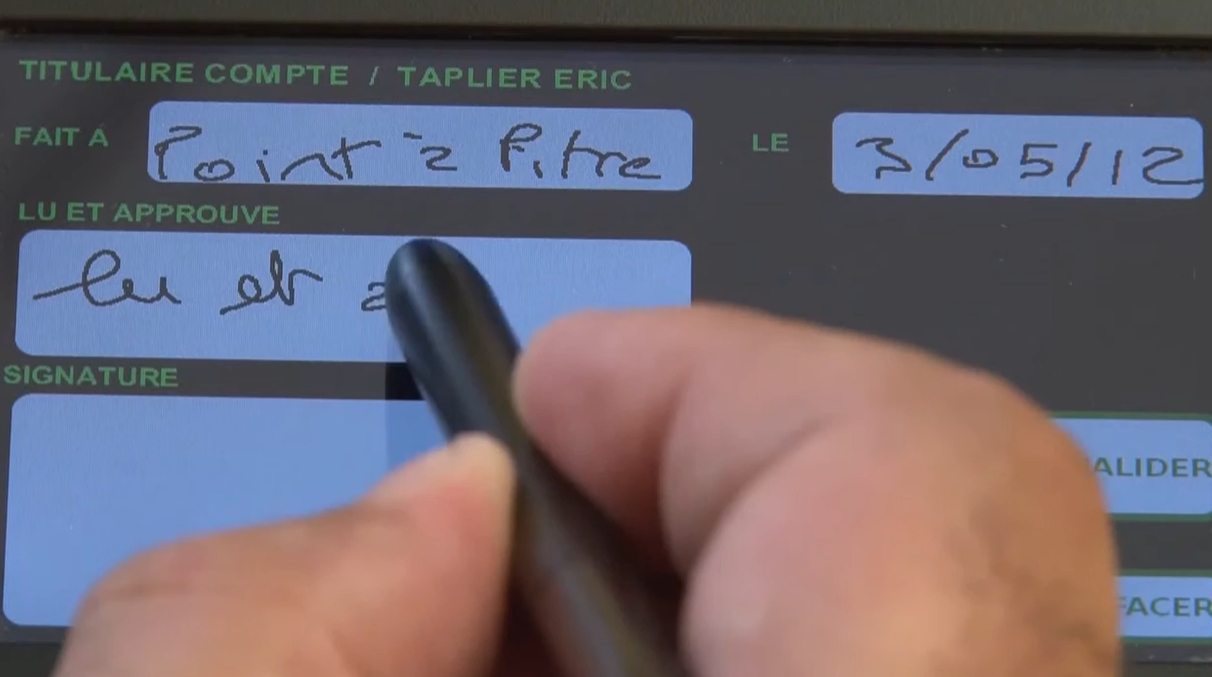

In the past, bank tellers needed to print multi-page contracts for customers, scan them for archiving after signing, and the whole process took at least 5 minutes. After using the electronic signature pad, the contract can be directly displayed on the screen, customers can sign immediately, and the system automatically archives it. The business processing time can be shortened to 1-2 minutes. For branches with long queues during peak hours, this means that more customers can complete their business within the same time.

More efficient document archiving and retrieval

Paper documents take up a large amount of storage space and are also at risk of being lost or damaged. The electronic signature pad directly saves the signed documents to the bank's document management system, and the corresponding information can be found within seconds when retrieving, greatly improving the efficiency of internal audits and regulatory inspections.

Higher security and compliance

The best electronic signature pads are equipped with functions such as handwriting pressure sensing, signing process encryption, and timestamp recording to ensure that each signature can truly restore the customer's writing characteristics. Data encryption and anti-tampering technologies can meet the compliance requirements of financial regulations for electronic signatures (such as the Electronic Signature Law and international standards).

Upgraded customer experience

For customers, there is no need to repeatedly turn pages and sign when handling business. The key terms are directly displayed on the screen, and the signing process is simple and intuitive. Especially in VIP wealth management centers and corporate customer service scenarios, the modern experience brought by electronic signatures can better reflect the bank's technological image.

2. Key indicators for banks to select the best electronic signature pad

First, a high-resolution (≥1080P), 10-13-inch screen suitable for signing is required, which is convenient for signing and reading contract terms. Then, at least 4096 levels of pressure sensitivity are needed to truly restore the customer's handwriting habits and provide a more reliable basis for anti-counterfeiting identification.

Secondly, data security should be ensured, supporting end-to-end encryption, optional local storage, and irreversible tampering of signed data, which complies with bank IT security specifications and can be seamlessly docked with existing business systems. Finally, it is about durability and stability. The daily usage frequency at bank counters is high, and it needs to work for a long time. Otherwise, a malfunction during work will seriously delay customers' time. In addition, the system can be docked with Windows, Linux, and the bank's self-developed core business systems, and supports customized APIs. These are all basic requirements.

Based on these indicator parameters, we recommend the UGEE signature UD1330 model electronic signature pad, with a high-definition resolution of 1920*1080, 8192-level pressure sensitivity, a 13.3-inch screen, a reading speed of 200 points per second, plus a passive electromagnetic pen.